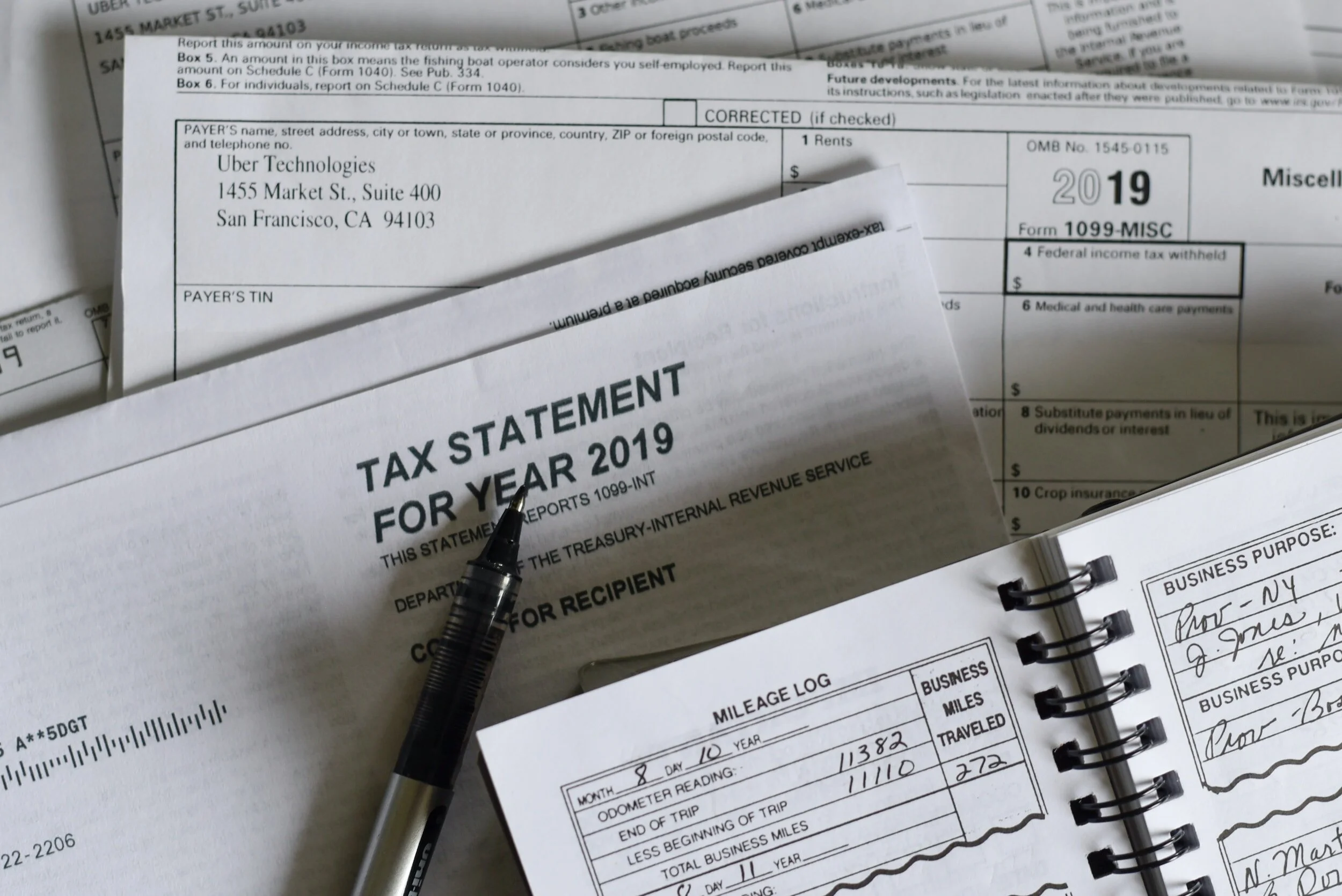

As you prepare for the 2024 tax filing season and look ahead to 2025 tax planning, reviewing specific tax considerations that could impact your return is essential. Below are key areas to focus on to maximize deductions, minimize liabilities, and optimize financial strategies.

Does Your Will Need To Be Updated?

How to Find a Good CPA

If you are a reader of the Wall Street Journal, you may have seen three articles in the past nine months that addressed the issue of a significant shortage of accountants. According to the most recent data from the American Institute of Certified Public Accountants, the number of US students graduating with either a bachelor’s or master’s degree in accounting dropped 7.4% during the 2021–22 academic year from the year before, the largest one-year decline since at least 1994–95.

The Pass-Through Entity Tax

The "Tax Cuts and Jobs Act" (TCJA) of 2017 brought a significant shift in the taxation landscape for individuals and businesses. One of the changes was the $10,000 cap on deductions for state and local taxes (SALT). This limit impacted the tax strategy of many high-tax states, pushing them to find ways to mitigate the impact of this cap on their taxpayers.

Reflections on Reaching Retirement Age as I Turn 65

Are you avoiding New Jersey taxes on your IRA distributions?

Portfolios of the Ultra-Wealthy and Access to Private Equity

Recently there has been considerable debate about providing investors with less than $5 million opportunities to invest in private equity (PE). A prior SEC chairman said, “the requirement that allows only wealthy investors access to PE does not provide the same investment opportunities to smaller investors.”